◼️ Unlocking Cash Flow in Your Business Through Smarter Borrowing

This Issue's TLDR...

👉 Did someone forward you this newsletter? First of all, give them a crisp high five when you see them. Second, head over here to subscribe and read past issues. BEST From MeThis week kicks off a three-part series on debt financing for your Amazon (or eCommerce!) business. If you don't need capital to grow your Amazon business: Congrats! You're in the minority. Everyone else, pay close attention to the next three issues of B@A and save them for future reference. Part 1: The Different Types of Debt Financing for your Business Part 2: A Side-By-Side Comparison of Debt Options (and How to Evaluate Them) Part 3: Insider Secrets from a Commercial Lender * People often ask what I do these days. Where I "fit" in the Amazon ecosystem. The short answer is that I wear a lot of different hats, and don't fit cleanly in any given circle. The slightly longer answer is that most of my "Amazon consulting" happens at the intersection of Amazon brand operations and commercial financing. Put differently, most of what I do these days is help Amazon business owners secure low cost capital that doesn't bury them under a mountain of debt while also ensuring that there's enough "dry powder" for growth. I basically help owners cut through the Turns out, being honest in the finance world is something of a rarity and, outside of an early career in finance that makes me a bit more conversant in finance-speak than the average business owner, I'm mostly just a guy that likes to help people get out of tough situations. To that end, I want to use this B@A platform to educate; to provide "prophylactic information" about debt financing for Amazon/eCommerce businesses. If, by reading this newsletter, a single business owner takes a pause and reaches out to me before signing an agreement for "growth capital" that was made available to them in less than 48 hours, then I've succeeded. So, without further ado, let's start this series with some basic education around the different types of debt. Part 1: The Different Types of Debt Financing for your BusinessDebt financing comes in various shapes and sizes, each tailored to different business needs and stages. What's a bit frustrating though, is that the debt options in the Amazon space are often hidden beneath jargon ("growth capital") and obfuscation. I know this because I speak regularly with lenders, who are often updating me on "new" products that they're introducing. I actually had one lender tell me that they were launching a Working Capital Line of Credit product; but, when I pressed for details, it was really just a Term Loan. C'mon man. So, with that being said, here's a comprehensive look at the typical debt options for Amazon/eCommerce businesses, in order of best to worst (in most cases): Line of Credit

Term Loans

Purchase Order (PO) Financing

Invoice / Receivables Factoring

Revenue-Based Financing (RBF)

Merchant Cash Advances (MCA)

BEST from Everyone ElseBest Deal That I've Seen This WeekRegular B@A readers know that I'm an advocate of Acquisition Entrepreneurship (AE). When I last wrote about AE, I said that I would start to share more AE-related educational content in here, as well as deals that I've looked at. Well, that starts today. Here's a deal that I would jump at, if not for the fact that I'm a little busy right now with my own Amazon agency acquisition: 🎣 Sports & Outdoors Brand

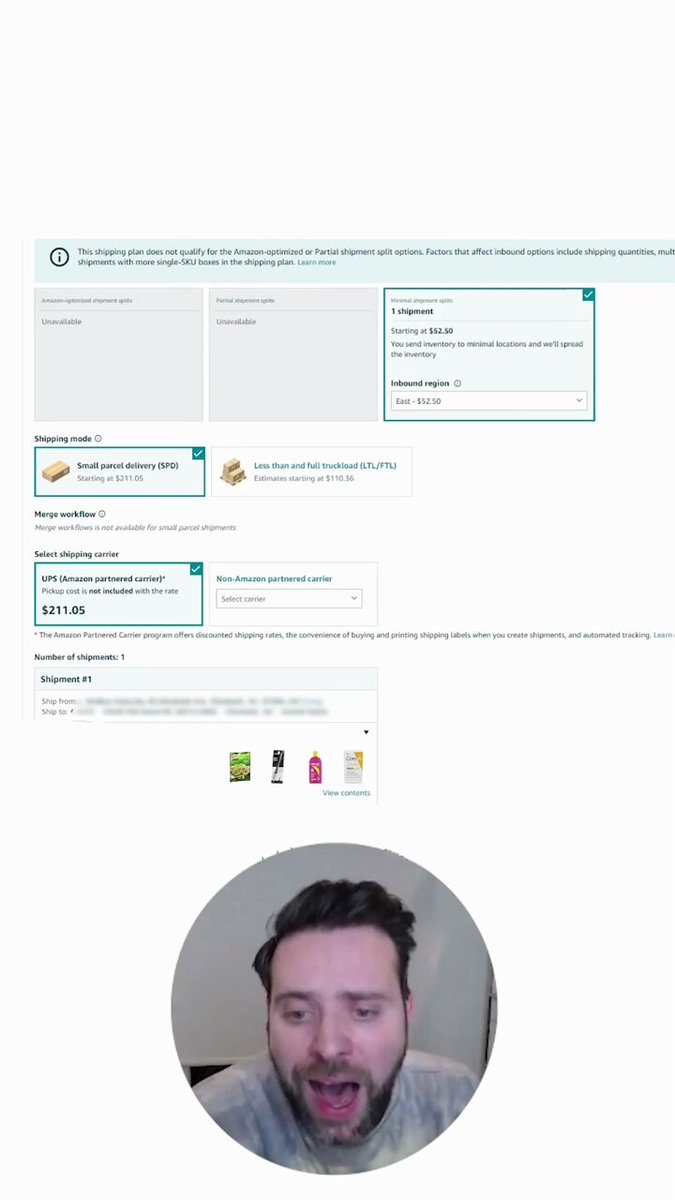

ASKING PRICE: $288,000 + Inventory 👍 BEST Reason to Buy: I often tell clients and students that there are four ways to "win" with an acquisition: 1) Organic growth, 2) Remove costs, 3) Buy below your basis, 4) Multiple expansion/arbitrage. In this case, the asking price (1.6x) is quite an attractive entry point. It gives a lot of room for error and/or investment into the business. 👎 BEST Reason NOT to Buy: This is a business where you are "buying a job." Although there's a healthy top-line, this business is a one-man shop and current EBITDA is a bit low to hire a General Manager or a large team. You will need to be an experienced Amazon operator to step into this one. PS: If you're interested in pursuing this deal, respond to this email and I'll share more details. Best From XEvery single seller feature and fee that Amazon has launched in the past year has been buggy. And, look, that's just sort of the way Amazon rolls. When I worked there, we regularly launched things before they were ready, and "fine-tuned" them along the way. But, there have been REAL costs to sellers with some of these premature launches. Likely in the $100s of millions of dollars in just a few short months. One such cost? With the FBA Inbound Placement Fees, sellers don't always have the options to choose partial splits or Amazon-optimized splits. In other words, Amazon is forcing sellers to pay the FBA Inbound Placement troll toll, whether sellers want to or not.

Amazon's language around what determines availability of split shipments is, in true Amazon fashion, rather opaque: Factors that affect inbound options include shipping quantities, multi-SKU boxes, and geographical demand. OK, bro. Thanks. So, how do you force split shipments when Amazon doesn't want to give them to you? Well, Option 1 is to use the API. Option 2? Try switching from shipping Individual Units to Cases. My friend Larry Lubarsky from 2D Workflow explains:

Best From LinkedInWhen I was at Amazon, one of the phrases that I repeated to sellers was: Customers prefer FREE shipping over FAST shipping. That wasn't me talking out of my a$$. Canada Post (i.e., USPS for Canada) had done several studies on this, throughout the 2010s, and the result repeated itself. This was a durable truth of shipping and parcel delivery. But...it's 2024 now. We're a different society in a lot of ways. COVID changed a lot of shopping behaviors and preferences. So...the question is...do customers *still* prefer free shipping over fast shipping? YES! Updates to the Amazon Private Label PathwayNo updates this week. * Back Story on the Amazon Private Label Pathway, ICYMI... A few months back, I had a small group of coaching clients that were at the same point in their Amazon seller journeys. I found myself answering the same questions, and pointing them to the same resources, so, in true Amazon fashion, I asked myself "What's the 1-to-Many solution here?" and built a Notion page of helpful resources, which I've called "Amazon Private Label Pathway." You can get access to it here: https://auxo.gumroad.com/l/amazonpathway (it's free; but if you want to buy me a beer, I won't object) |

Best @ Amazon

I'm a former Amazon marketplace leader and current 8-figure seller. I write about advanced strategies and tactics for Amazon brands, that you won't read about anywhere else. Not for beginners.

This Issue's TLDR... How to clone the brain of your favorite thought leader Hourly ranking on Amazon The dangers of AWD 👉 Did someone forward you this newsletter? First of all, give them a crisp high five when you see them. Second, head over here to subscribe and read past issues. And, be sure to read my most popular issue ever: 15 Cool Hacks For Your Amazon Business. HIRE MY AGENCY ($$$) SPONSOR BEST@AMAZON ($$) GET AMAZON ADVICE ($) ACCESS AMAZON PRIVATE LABEL PATHWAY (FREE!) SPONSOR My...

This Issue's TLDR... How it started vs How it's going for Carbon 6 The Amazon Affiliate ecosystem Walmart price fixing 👉 Did someone forward you this newsletter? First of all, give them a crisp high five when you see them. Second, head over here to subscribe and read past issues. And, be sure to read my most popular issue ever: 15 Cool Hacks For Your Amazon Business. HIRE MY AGENCY ($$$) SPONSOR BEST@AMAZON ($$) GET AMAZON ADVICE ($) ACCESS AMAZON PRIVATE LABEL PATHWAY (FREE!) SPONSOR TrueOps...

This Issue's TLDR... Amazon Creative Studio is...getting kinda good Prime Day dates...leaked? The only things that matter in business (if you want to win) 👉 Did someone forward you this newsletter? First of all, give them a crisp high five when you see them. Second, head over here to subscribe and read past issues. And, be sure to read last week's issue about How To Use DSI To Drive Decision-Making. Or, read my most popular issue ever: 15 Cool Hacks For Your Amazon Business. HIRE MY AGENCY...